The disruptive impacts of the COVID-19 pandemic on the U.S. agricultural system have been broad and varied. And they follow several years of trying production and market conditions for U.S. farmers. In 2017 and 2018, several hurricanes pummeled U.S. farms; 2019 brought historically poor planting conditions and retaliatory tariffs cut potential for our agricultural exports compared to 2017.

This year, farmers and consumers have been planning production and managing household budgets at a time when markets — food, commodity, labor, energy — are being jolted by global, national and regional shutdowns, slowdowns, and overall uncertainty. Those shocks to the U.S. and global economies have affected both the supply and demand for food in the U.S. and the rest of the world, leading to short-term, localized shortages in the U.S., particularly in livestock products like meat, while farmers had to deal with, for example, excess milk supplies in other areas.

In general, U.S. food prices have risen since January while prices received by U.S. producers have fallen. But while rising wholesale and retail food prices and some temporarily empty shelves drew a lot of public attention and stoked fears over availability and affordability of our food, the severe impacts of the crisis on U.S. farmers have been much less visible.

Here we share some information and data on farming operations and how the crisis has impacted U.S. farmers over the past few months.

Tough times have been underway for years

The COVID-19 pandemic not only triggered a new type of crisis for the farming sector, it also came at a tough time for U.S. farmers. For the past few years, global commodity production has outpaced demand in most years and prices have been falling. Since the historic 2012 U.S. drought and peak in commodity prices in 2013, global commodity production has generally outpaced demand, fueling continued price declines – in nominal and real terms. Between 2012-2019, producer prices for corn fell 48% from $6.89 per bushel to $3.56, and producer prices for soybeans fell 40% - almost six dollars per bushel Prices for cattle, hogs, broilers and milk have also been on downward trend over the past 5 years. However, cost of production for these commodities in 2019 was higher or only marginally lower than five years earlier (see chart 1).

Chart 1: Commodity Cost of Production

During the same period, many of our global competitors, supported in part by advantageous currency values, have ramped up production for export —wheat in the Black Sea region, and corn, soybeans, and cotton in South America. Meanwhile, U.S. farmers have had to deal with a significant economic (tariffs) and weather-related challenges (drought and hurricanes) that have kept production costs relatively high, squeezing the margins for many crop, livestock, and dairy farmers.

Clear signs of financial distress had emerged among U.S. farmers even prior to the onset of the COVID-19 outbreak. Investment in equipment was down, farmer debt was up, and so was borrowing against land. By the end of 2019, the delinquency rate on commercial loans hit a six-year high, and the delinquency rate on farmland loans was at its highest level since 2013.[1] Inflation-adjusted farm income increased in 2019, but only when including federal farm aid payments and indemnities for crop insurance. Some of those payments were specifically introduced to assist farmers in adjusting to market disruptions caused by the retaliatory tariffs imposed by China and other countries on U.S. agricultural exports and the unprecedented levels of weather-induced prevented plantings in 2019.

COVID-19 exacerbated the challenges facing farmers

The rapid proliferation of COVID-19 at home and abroad and subsequent shutdown of parts of the economy led to unprecedented and simultaneous supply and demand shocks to the food system.

Crude oil prices, which began the year at $61.18 per barrel, briefly traded negative for the first time ever in April. Grocery store retail sales rose sharply while sales at food service and drinking places during March and April were $47.5 billion lower than during the same period in 2019.

The consequences of the crisis for farmers and their families were immediate and severe. For example, the reduction in miles driven as the public sheltered in place, meant less demand for biofuels, which in turn led to reduced demand for grains used in biofuels, particularly corn. In addition, the immediate and drastic decline in food demand by restaurants and hotel customers isolated farmers and food processors from some of their biggest buyers, especially for meat, dairy, and specialty crops. As a result, we have seen agricultural commodity prices also decline significantly over the past few months (see chart 2). In recent weeks we have seen a reversal in some prices as global demand is recovering.

So as consumers were dealing with localized food shortages and rising retail food prices, producers were grappling with falling farmgate prices and a glut of output that forced them to euthanize livestock, dump milk, and dispose of perishable products that could not be stored. Data on differences in prices at the farm and retail levels show that, as of August, the price paid by consumers for one pound of retail beef, for example, has risen by 5 percent since January, 2020 (a significant fall-off from June, when it was 30 percent higher), while cattle producers are receiving 20 percent less for their cattle. Similarly, milk prices are up by nearly 5 percent for consumers since the beginning of the year, and milk prices received by dairy farmers, although were up 5 percent as well in August, they follow successive decreases in prices received from February through June, including a 31 percent decrease from January to June.

The loss of jobs across the country have also hit farm families hard. In mid-June we saw rates of unemployment of 8.8 percent in rural areas, compared with 11.6 percent in urban areas.[2] While farming-dependent counties suffered fewer job losses than most other regions, many farm families rely on off-farm income to help with health coverage and to offset losses on the farm operation [3]. With the unprecedented number of job losses we have seen since January, the impact on farm families and their finances could be extreme particularly for farms for which operating margins are so thin right now.

According to a recent analysis by the Federal Reserve Bank of Kansas, the volume of total non-real estate loans declined for a fourth consecutive quarter, falling by 13 percent in the second quarter of 2020 compared to a year ago.[4] The analysis shows that the largest decline in loan volume was for livestock feeder loans, which fell more than 40 percent from a year ago. Outstanding farm debt during the second quarter of 2020 also declined with the slowdown of lending; yet, farm loan delinquency rates continued to edge higher (chart 3a&b).

Chart 3a&b: Delinquency rate and total delinquent balances on Farm Loans

Although comprising less than 2.5 percent of farm loans, the volume of delinquent farm real estate and non-real estate loans increased about 17 percent and 13 percent, respectively, compared to a year ago. The volume of loans past due more than 90 days continued to account for the smallest share of total delinquencies, but increased at a similar rate, suggesting that previously past due loans remained delinquent.

Unprecedented crises called for unprecedented measures

The magnitude and speed with which the COVID-19 outbreak affected the economy in general, and the food system in particular, motivated Congressional action in the CARES Act and dictated the scale and nature of USDA’s responses. It became quickly obvious that this crisis was nothing like we have ever experienced and that it could pose a real threat to the viability of many farming operations and, with it, to the sustainability of our domestic food supply. While evidence at a national scale is not yet available, losses by Texas agriculture alone were estimated at $6 - $8 billion, or 28-37 percent of the state’s cash receipts in 2019.[5] USDA’s most recent forecast for farm income for 2020, from September 2 projected that producers would receive $31 billion less this year in cash receipts compared to pre-COVID income forecasts from February.[6]

Mitigating the crisis required a wide range of measures targeting all aspects of the food supply and demand system and its different stakeholders. Most critically, USDA initially provided assistance through the Coronavirus Food Assistance Program (CFAP 1) estimated to provide up to $16 billion to U.S. farmers and ranchers to help them deal with the significant income losses they incurred during the pandemic. Following the enactment of the CARES Act in March, USDA quickly developed a broad program to help producers experiencing revenue losses and facing new costs, with sign-ups starting in late May. Payments were made available to producers experiencing losses from across the broad spectrum of U.S. agriculture[7].

Positive signs, but uncertainty continues

Earlier this year, when we released the Department’s initial projections for 2020 at USDA’s Agricultural Outlook Forum, the immediate future looked to be improving (www.usda.gov/oce/ag-outlook-forum). We were expecting better weather, improved trading relationships, and global economic growth that would fuel demand for US agricultural exports. The COVID-19 outbreak has severely dampened expectations for 2020 and 2021. And while the timing and pace of the economic recovery remain uncertain, the fundamentals of U.S. agriculture are sufficiently strong to withstand the crisis.

The sector continues to chart productivity gains; and smart policies, technology, and innovation are helping farmers deal with the effects of adverse weather conditions. Although the early August derecho in the Midwest, the severe fires in the West, and the more recent Hurricane activity in the Gulf have caused localized losses, from a national perspective weather conditions have improved relative to 2018 and 2019, signaling a more bountiful harvest in the fall. Record levels of meat and dairy production are expected in 2020 and 2021.

We know that U.S. agriculture is highly competitive in global markets, and the trade outlook is looking more favorable with expected global economic recovery in 2021. Overall, agricultural exports during the COVID-19 period appear to have been holding up relatively well compared to overall U.S. exports. In the first seven months of 2020, U.S. ag exports were down 3.5 percent from last year compared to a decrease of 18 percent for non-ag exports. Just recently we have seen a major uptick in Chinese purchases. For instance, while U.S. soybean exports had started off slow this year, since July, China has purchased 14 MMTs. Over the past few months, China has also signaled the intent to purchase corn at amounts exceeding its 7.2 MMT quota if they all finalized. Purchases are up across the board, with total accumulated sales for wheat, sorghum, cotton, pork and beef exceeding the pace of 2017 levels year-to-date.

The limited impact of the crisis on overall agricultural exports reflects the fact that demand for food is relatively income-inelastic, and that marine transportation used for most agricultural products (in particular bulk products) has not been significantly disrupted. U.S. agricultural exports in Fiscal Year 2021 are projected at $140.5 billion, up $5.5 billion from the FY 2020, primarily driven by higher exports of soybeans and corn. Soybean export volume is forecast to rise nearly 26 percent year-over-year as growing demand in China and significantly reduced export volume forecast from Brazil opens the door for a rise in U.S. exports. Corn exports are also forecast to rise $700 million to $9.0 billion in FY2021 and horticultural exports by $500 million to $35.0 billion due to expected increase in sales of tree nuts, among other products. Similarly, livestock, poultry, and dairy exports are forecast up $500 million to $32.3 billion.

But despite these encouraging signs, many U.S. farmers continue to confront significant challenges and the immediate outlook for the sector remains highly uncertain. In many cases, producers didn’t experience the full impacts of markets disrupted by COVID-19 until just recently. Think of a sweet potato grower that has just begun to harvest his or her crop and now has nowhere to send it – and they incur unexpected costs to dispose of the portion they cannot sell. Or a potato grower whose contracts with potato processors for potatoes destined for restaurants have been cut in half. Those producers began to experience higher costs and lower revenues as a result of COVID-19 only recently.

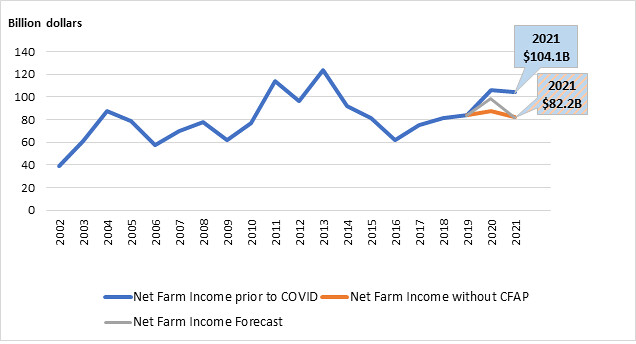

And the impacts of COVID-19 are expected to continue into next year: a forecast by the Food and Agricultural Policy Research Institute at the University of Missouri expects farm income to fall by $21.9 billion in 2021 compared to their forecast prior to COVID-19, even when accounting for higher payments from farm bill programs.

Chart 4: Net Farm Income: FAPRI Estimates with COVID Impacts and CFAP, assuming no CFAP payments in 2021

Data: University of Missouri

www.fapri.missouri.edu/wp-content/uploads/2020/03/2020-U.S.-Agricultural-Market-Outlook.pdf (PDF, 2.7 MB)

www.fapri.missouri.edu/wp-content/uploads/2020/03/2020-online-baseline-tables.xlsx

www.fapri.missouri.edu/wp-content/uploads/2020/09/September-2020-Farm-Income-Update.pdf (PDF, 1.4 MB)

Notes: Net Farm Income prior to COVID (NFI - blue line) represents the forecast in the absence of COVID-19 impacts in 2020 and 2021. The grey line accounts for COVID market impacts and the Coronavirus Food Assistance Program (CFAP) payments to agricultural producers. Net Farm Income without CFAP (orange line) represents a forecast of net farm income accounting for COVID-19 impacts but no direct payments from CFAP 1.

Note, the FAPRI farm income forecast for 2020 includes $11 billion for CFAP 1 (unlike the ERS forecast which included $16 billion) and $5.8 billion in loans forgiven under the Paycheck Protection Program. Also, the FAPRI farm income forecast from early September 2020 did not include any payments related to CFAP 2.

The prospect of continuing COVID-19 impacts in 2020 and 2021 has led Congress to consider additional assistance to help agricultural producers adjust to disruptions in domestic and global agricultural markets. Earlier this month, USDA announced the second round of the Coronavirus Food Assistance Program (CFAP 2), which will provide additional assistance of up to $14 billion to farmers facing market disruptions caused by COVID-19 in the second through fourth quarters in 2020. CFAP 2, which is based on appropriations from the earlier CARES Act, covers a more expansive range of commodities compared to CFAP 1, such as turkeys and all table eggs, and simplifies the application process for specialty crops.[8]

The CFAP program together with the recent surge in exports of some agricultural commodities have provided much-needed relief for the farming sector. But with much uncertainty still clouding the horizon, it’s hard to tell whether the tough times are over for farmers or more still lie ahead.

- www.federalreserve.gov/releases/chargeoff/delallsa.htm

- (see www.ers.usda.gov/covid-19/rural-america)

- (www.ers.usda.gov/amber-waves/2020/march/family-farm-households-reap-benefits-in-working-off-the-farm)

- www.kansascityfed.org/research/indicatorsdata/agfinancedatabook/articles/2020/7-16-20/ag-finance-dbk-7-16-2020

- www.afpc.tamu.edu/research/publications/files/698/RR-20-01.pdf

- USDA-ERS Farm Income and Wealth Statistics: www.ers.usda.gov/data-products/farm-income-and-wealth-statistics

- www.usda.gov/media/press-releases/2020/05/19/usda-announces-details-direct-assistance-farmers-through

- Details of the CFAP2 assistance package can be found at www.farmers.gov. Sign-up began Monday, September 21.